SYDNEY, AUSTRALIA - 18 JULY 2024 - Symphony Infrastructure Partners Pty Ltd (‘Symphony’) is pleased to announce the completion of a $488 million Series-A financing round led by funds managed by Blackstone (NYSE: BX) (‘Blackstone’) investing $300 million, supported by a $188 million senior debt facility from Commonwealth Bank of Australia (‘CBA’).

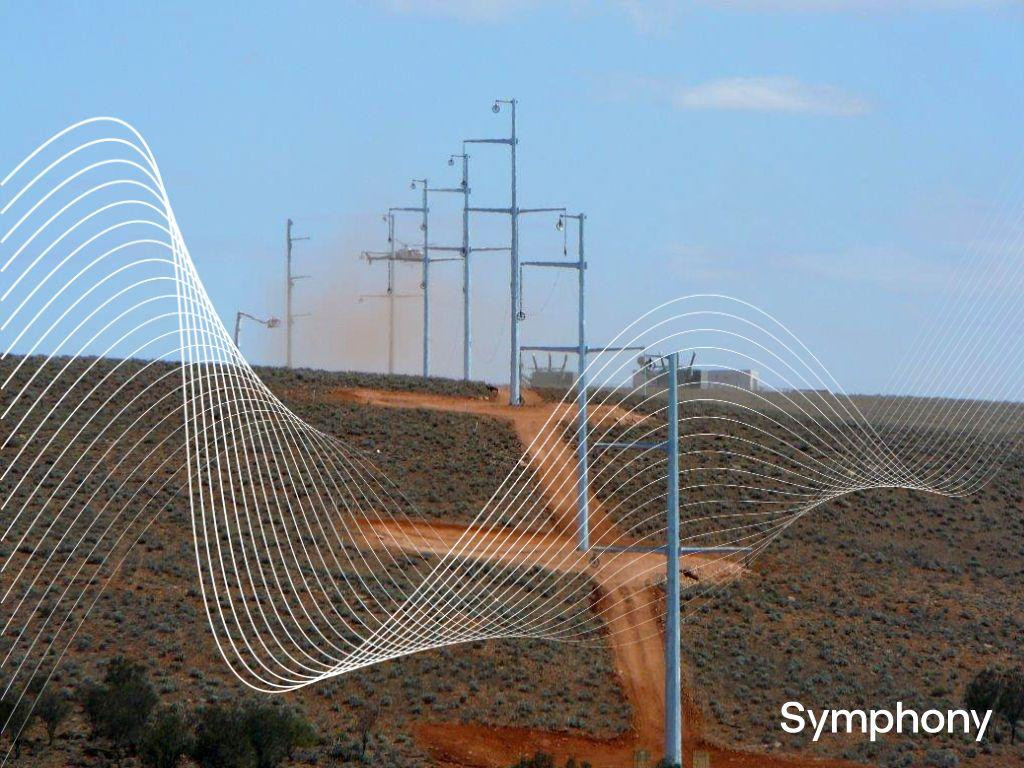

Symphony was established in 2022 to develop operate and own specialised infrastructure services critical to Australia’s energy transition. The funding enables Symphony to complete the acquisition of five new portfolio companies establishing one of Australia’s leading independent energy infrastructure services platforms. Together with its existing businesses, Symphony provides for customers an end-to-end integrated solution for major transmission infrastructure and grid connection services. With over 1000 staff and operations nationally, Symphony will continue to invest to significantly expand the capacity of its portfolio companies to accelerate the energy transition.

"We found strong alignment with Blackstone on understanding the scale, complexity and opportunity of the energy transition. We are delighted to be partnering with a world-class investor of Blackstone’s scale and expertise to fund our continued growth” said Steven Butler, Group Chief Executive Officer of Symphony. "This financing round marks a significant milestone in delivering on our sole mission as a group - to accelerate the energy transition. With the support of Blackstone and CBA we are strongly positioned and capitalised to execute that mission with scale and speed for our customers and the communities that we serve.”

Daniel Kearns, Managing Director at Blackstone, said, “The energy transition is a major investment theme for our firm both globally and in Australia. Australia is at the beginning of its energy transition journey, and we couldn’t be more excited to partner with what is a market-leading platform in Symphony.”

CBA General Manager Corporate Finance Jade Astbury said, “We are delighted to support Symphony’s next phase of growth. Accelerating the energy transition and scaling up domestic renewables capability and capacity is integral to our transition to a sustainable economy. Symphony has demonstrated leadership and vision and this transaction is a fantastic example of how financing private enterprise is helping capture opportunities in greening the grid.”

Symphony was supported by financial advisor Lazard Australia and legal advisers Allens and Kain Lawyers.

For more information, please visit www.symphonyinfra.com.au

For Media inquiries please contact media@symphonyinfra.com.au

-END-

About Blackstone

Blackstone is the world’s largest alternative asset manager. We seek to deliver compelling returns for institutional and individual investors by strengthening the companies in which we invest. Our more than $1 trillion in assets under management include global investment strategies focused on real estate, private equity, infrastructure, life sciences, growth equity, credit, real assets, secondaries and hedge funds.

About CBA

The Commonwealth Bank of Australia (CBA) is Australia’s leading provider of integrated financial services. Founded in 1911, CBA now employs over 48,900 people across the Group, helping to support 15.9 million personal, business and institutional customers.

About Symphony

Symphony is orchestrating a market leading portfolio of end to end integrated solutions for transmission infrastructure and grid connection services. Symphony is consolidating and scaling Australian sovereign capability, pairing on the ground capability with institutional capital markets to accelerate the energy transition.